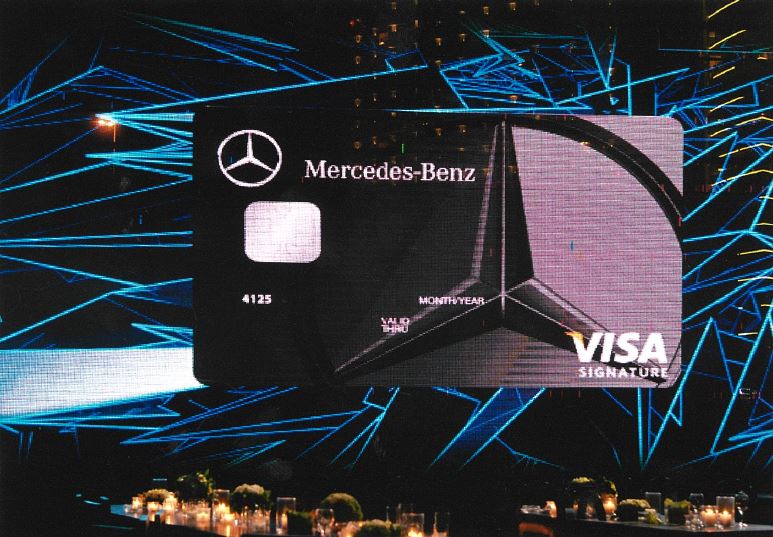

Introducing “The Metallic” card from Credit Libanais.

The exclusive metal card, first of its kind in Lebanon, offers elite clientele a wide array of services and privileges that cater to their lifestyles.

Made from metal, with a minimalist design, sleek look, refined touch and embedded with contactless technology, the card is meticulously crafted to redefine the cardholder’s status and surpass all expectations.

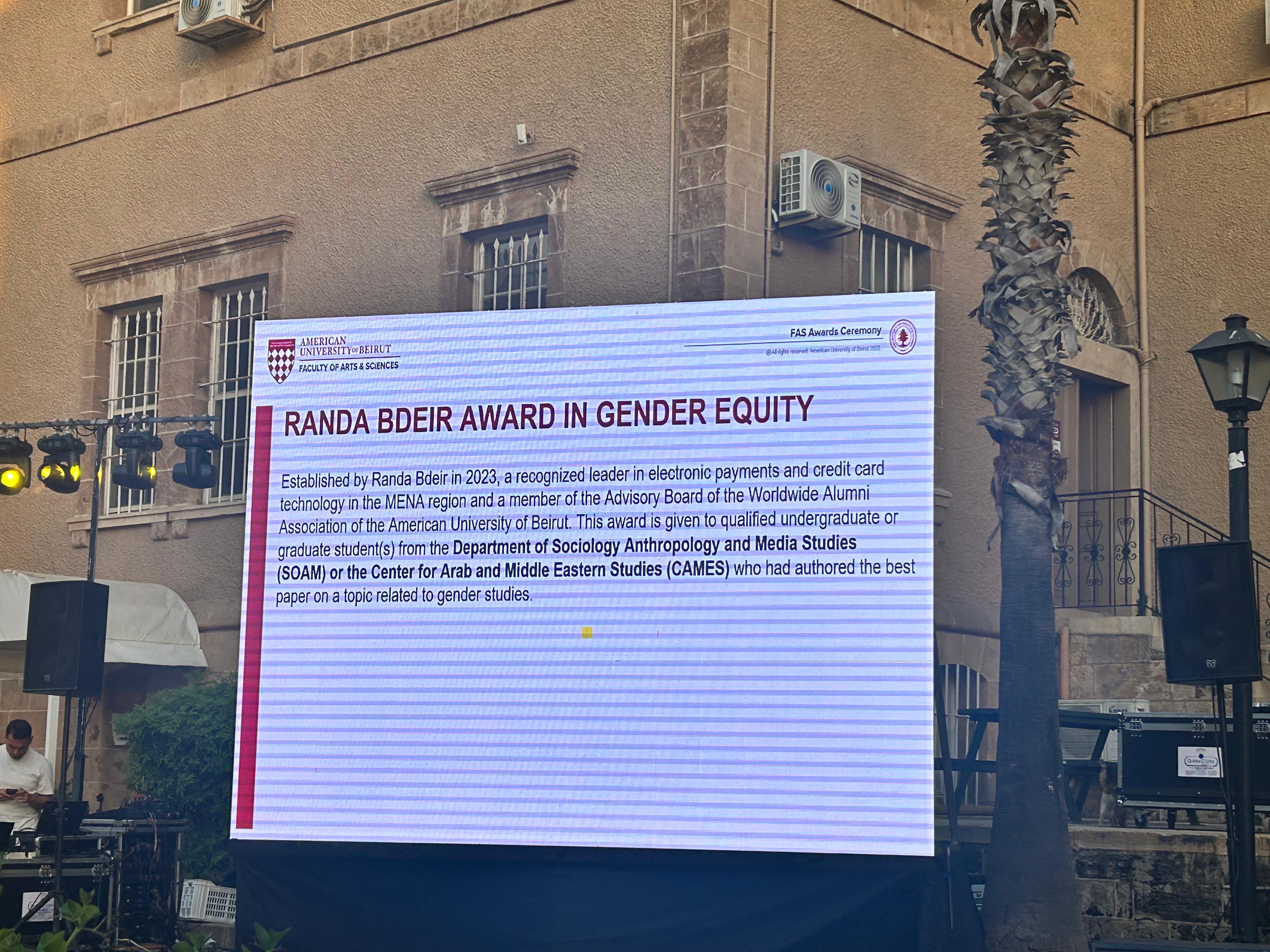

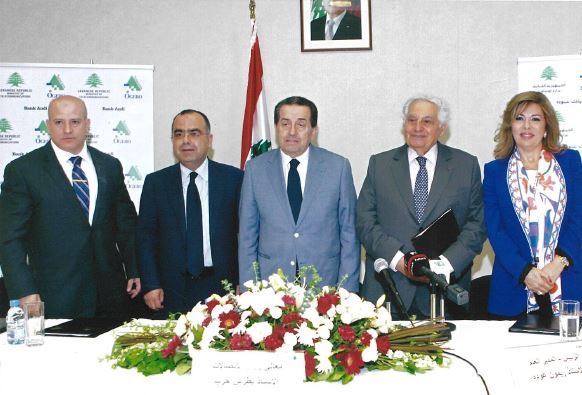

“’The metallic’ is more than just a statement, it comes with a top-of-the-line unique customer value proposition, offering tailor-made privileges.” Mrs. Randa Bdeir, Deputy General Manager and Head of E-Payment Solutions & Cards Technology at Credit Libanais.

The Metallic card from Credit Libanais, guaranteed to grab everyone’s attention and make its holder feel delightfully empowered.